Institution: Teacher Retirement System of Texas

Headquarters: Austin, US

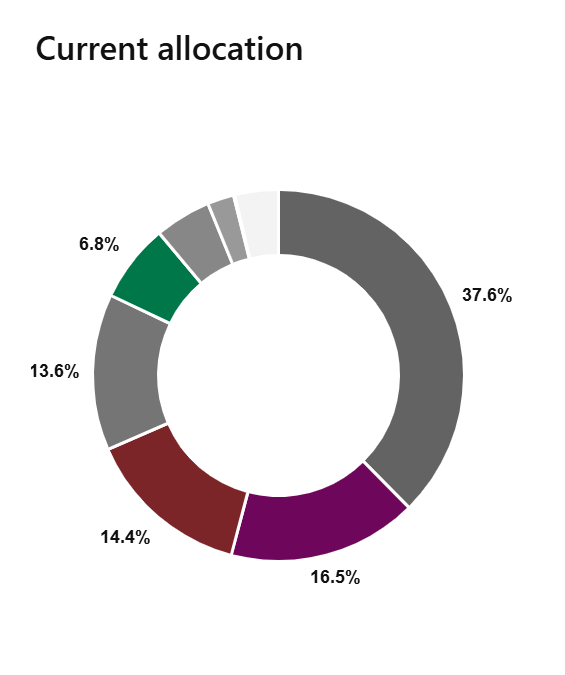

AUM: $211.6 billion

Allocation to private equity: 16.5%

The Teacher Retirement System of Texas has announced new commitments across four private equity funds, according to a source at the institution.

The Austin-based pension fund committed €125 million to Oakley Capital VI, managed by Oakley Capital Private Equity. This fund follows a buyout strategy and will invest in consumer goods, business services and TMT sectors. These investments will be focused on the Western Europe region, particularly in the UK, Germany, Austria, Switzerland, Italy, Spain and Portugal.

A $30 million commitment was also made to Jade II PB Coinvest, managed by Leonard Green & Partners. This fund also targets buyout opportunities, with an emphasis on the business services and consumer goods sectors in North America.

Texas TRS further committed $65 million to GTCR Strategic Growth Fund II, managed by GTRC. The fund, which launched in December 2024, focuses on growth equity opportunities in North America, particularly within the business and financial services, healthcare and TMT sectors.

The pension also committed $85 million to Falfurrias Capital Partners VI, a North American buyout vehicle that concentrates on the healthcare, TMT sectors, business and financial services sectors.

Texas TRS currently allocates 16.5 percent of its investment portfolio to private equity, exceeding its target allocation of 12 percent. The private equity portfolio amounts to $34.91 billion.

Platinum subscribers may click here for the investor’s full profile, including key contacts, allocation strategy and fund investments.