New joint ownership will support Omega Healthcare in accelerating their growth journey

New York, Toronto, December 20, 2024 – Ontario Teachers’ Pension Plan (“Ontario Teachers’”) makes investment in Omega Healthcare Management Services (“Omega” or “the Company”) and joins Private Equity at Goldman Sachs Alternatives as Co-Lead investors. Omega is a leading technology-enabled healthcare management solutions provider. Terms of the transaction were not disclosed.

Omega Healthcare works with healthcare institutions to empower them to deliver exceptional care while enhancing financial performance. Omega aims to help its clients increase revenues, decrease costs, and improve the overall patient experience through their comprehensive portfolio of technology-enabled and clinically-led solutions. Founded in 2003, Omega Healthcare has approximately 35,000 employees across 14 delivery centers in the United States, India, Colombia, and the Philippines.

With its exceptional management team and the continued, anticipated growth for healthcare revenue cycle management, Omega is well-placed to further strengthen its position in the market and with clients. Both investors will draw from their proven track records across client acquisition and value creation efforts, while also continuing to enhance Omega’s intelligent automation platform to accelerate the Company’s performance.

Greg Nielsen, Senior Managing Director, Digital & IT Services, at Ontario Teachers’ said: “While the U.S. healthcare industry continues to face complexities, we see considerable opportunity in technology-driven solutions that improve efficiencies and reduce costs for healthcare providers. We’re excited to partner with Goldman Sachs Alternatives and work alongside Anurag, Sumit and the entire Omega team to support the company’s continued growth.”

Goldman Sachs Alternatives has been an investor in Omega since 2019. Harsh Nanda, Managing Director and Head of Technology Private Equity within Goldman Sachs Alternatives, commented: “It is a privilege to work with the Omega team and witness up-close the drive and dedication to deliver outstanding outcomes for their customers. Ontario Teachers’ decision to join us as an investment partner is a testament to Omega management team’s vision and exceptionality. We are excited to see what we can achieve together.”

“We are thrilled to welcome Ontario Teachers’ into the Omega family and value the renewed commitment from Goldman Sachs Alternatives,” said Anurag Mehta, the Co-Founder and CEO of Omega. “This partnership reaffirms our commitment to leverage our unmatched domain expertise and our unique market-leading solutions to empower our clients. We look forward to accelerating development of our offerings across the Provider, Payer, and Pharma markets, to enable our customers to operate more effectively. I am incredibly proud of our management team for their relentless pursuit of excellence and grateful to our customers for their unwavering support.”

Advisors

Goldman Sachs & Co. LLC and TripleTree acted as co-lead financial advisors to Omega, and Weil, Gotshal & Manges served as legal counsel to Omega.

RBC Capital Markets, LLC served as exclusive financial advisor to Ontario Teachers’, and Latham & Watkins served as legal counsel.

About Ontario Teachers’

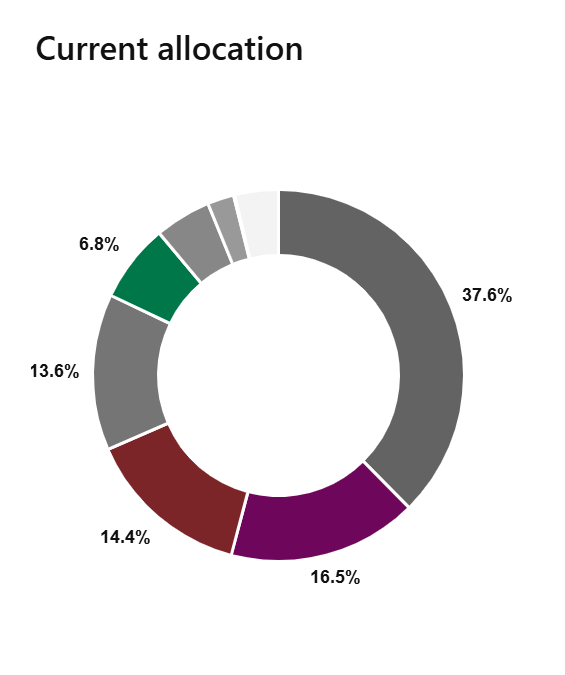

Ontario Teachers’ Pension Plan Board (Ontario Teachers’) is a global investor with net assets of $255.8 billion as at June 30, 2024. We invest in more than 50 countries in a broad array of assets including public and private equities, fixed income, credit, commodities, natural resources, infrastructure, real estate and venture growth to deliver retirement income for 340,000 working members and pensioners.

Our more than 450 investment professionals operate in key financial centres around the world and bring deep expertise in a broad range of sectors and industries. We are a fully funded defined benefit pension plan and have earned an annual total-fund net return of 9.3% since the plan’s founding in 1990. At Ontario Teachers’, we don’t just invest to make a return, we invest to shape a better future for the teachers we serve, the businesses we back, and the world we live in. For more information, visit otpp.com and follow us on LinkedIn.

About Private Equity at Goldman Sachs Alternatives

Goldman Sachs (NYSE: GS) is one of the leading investors in alternatives globally, with over $500 billion in assets and more than 30 years of experience. The business invests in the full spectrum of alternatives including private equity, growth equity, private credit, real estate, infrastructure, sustainability, and hedge funds. Clients access these solutions through direct strategies, customized partnerships, and open-architecture programs.

The business is driven by a focus on partnership and shared success with its clients, seeking to deliver long-term investment performance drawing on its global network and deep expertise across industries and markets.

The alternative investments platform is part of Goldman Sachs Asset Management, which delivers investment and advisory services across public and private markets for the world’s leading institutions, financial advisors and individuals. Goldman Sachs has more than $3.1 trillion in assets under supervision globally as of September 30, 2024.

Established in 1986, Private Equity at Goldman Sachs Alternatives has invested over $75 billion since inception. The business combines a global network of relationships, unique insight across markets, industries and regions, and the worldwide resources of Goldman Sachs to build businesses and accelerate value creation across its portfolios. Follow us on LinkedIn.

About Omega Healthcare

Founded in 2003, Omega Healthcare Management Services™ (Omega Healthcare) empowers healthcare organizations to deliver exceptional care while enhancing financial performance. We help clients increase revenues, decrease costs, and improve the overall patient-provider-payer experience through our comprehensive portfolio of technology-enabled and clinically led managed outsourcing solutions. Leveraging the Omega Digital Platform (ODP), customers benefit from the company’s expertise in artificial intelligence (AI), generative AI, robotic process automation (RPA), bots, machine learning (ML), and natural language processing (NLP), to drive greater efficiency and accuracy. Omega Healthcare has approximately 35,000 employees across 14 delivery centers in the United States, India, Colombia, and the Philippines. For more information, visit www.omegahms.com.

Contact Details

Ontario Teachers’

Dan Madge/James DeCosimo

Email: [email protected]

Goldman Sachs

Victoria Zarella

Email: [email protected]

Omega Healthcare

Marykate Reese

Email: [email protected]